Child Tax Credit 2024 Table C – The expansions on offer in the new bipartisan tax deal are more modest than the Covid-era changes, but advocates say the changes to the credit will reduce child poverty. . For the 2024 tax year, the child tax credit remains at up to $2,000, but the refundable portion of the credit increases to $1,700. This means eligible taxpayers could receive an additional $100 .

Child Tax Credit 2024 Table C

Source : www.investopedia.com

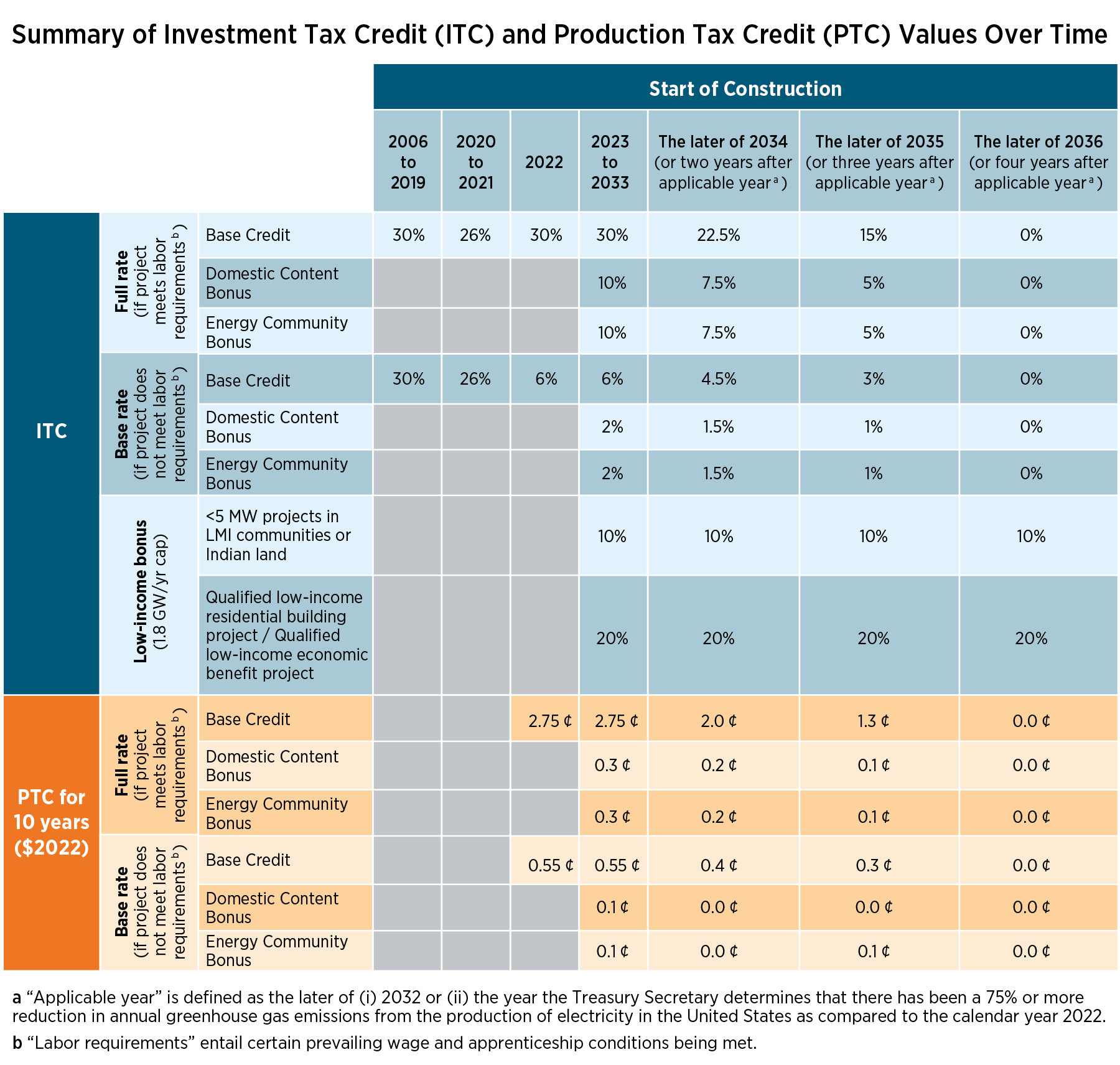

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

Garrett Watson on X: “End of 2025 is coming fast, folks! https://t

Source : twitter.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

NATO members Greece and Turkey pledge to ‘reset’ ties and bypass

Source : www.wdhn.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

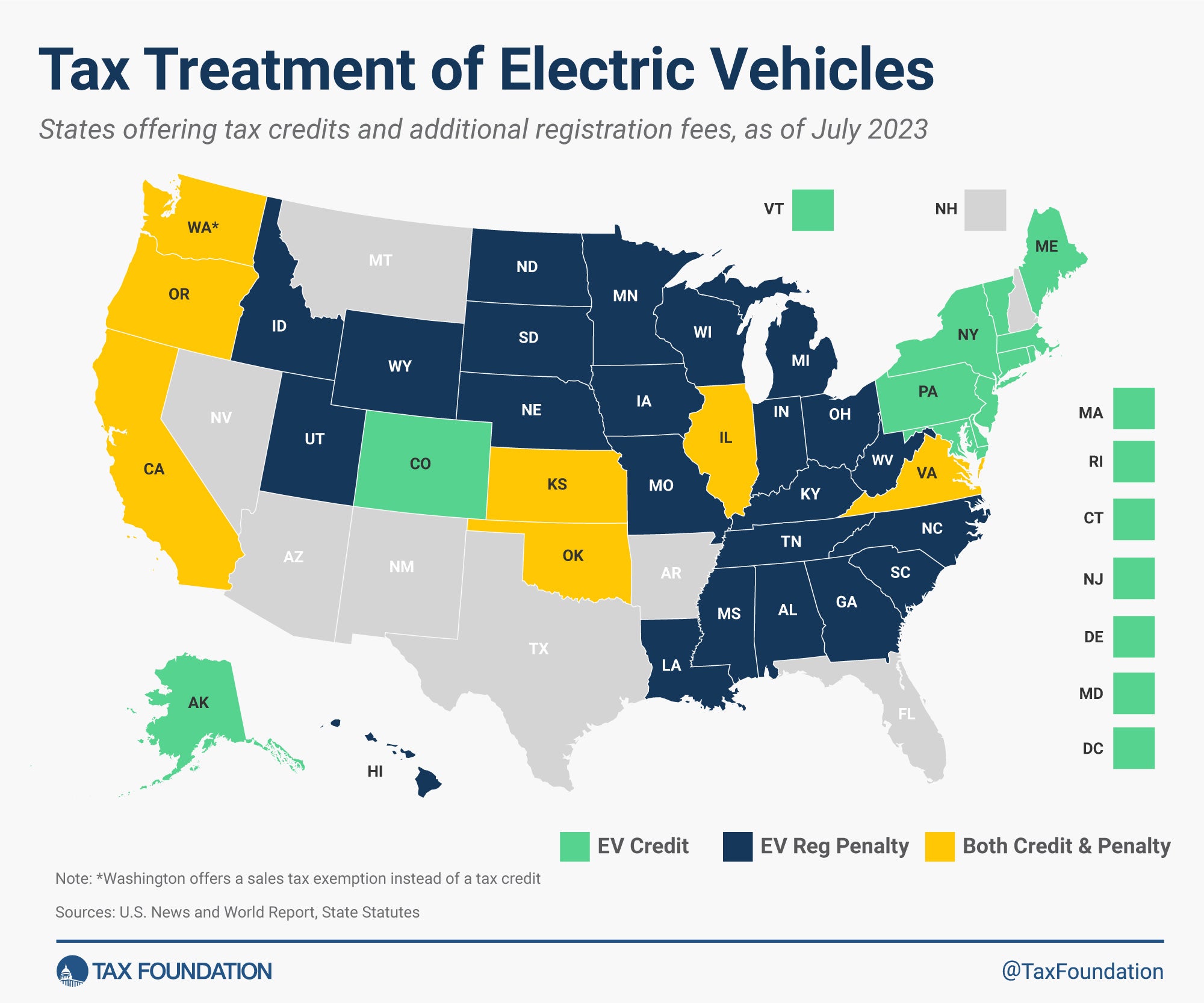

Electric Vehicles: EV Taxes by State: Details & Analysis

Source : taxfoundation.org

How to Fill Out a W 4: 2024 W 4 Guide | Gusto

Source : gusto.com

2024 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Source : taxfoundation.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Child Tax Credit 2024 Table C Child Tax Credit Definition: How It Works and How to Claim It: While you might already know about the 2023 child tax credit and other family tax breaks for the current year, here is what you can expect for the 2024 tax year (for income tax returns normally . A new version of the child tax credit, designed to lift kids out of poverty, is on the table. It has some momentum in Congress but also faces some obstacles. .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)